The Main Principles Of Late Or Unfiled Irs Tax Returns

Wiki Article

CPA

Address: 3155 W Big Beaver Rd Suite 218, Troy, MI 48084, United States

Phone: +1 248 524 5240

Transfer rates, i. e. the setting of prices in between legal entities within the exact same organization, has come to be a global problem. Relevant regulation is ending up being extra in-depth and demanding, and there is ever before better demand for correct documentation in order to reduce the danger of fines enforced by the regulative authorities.

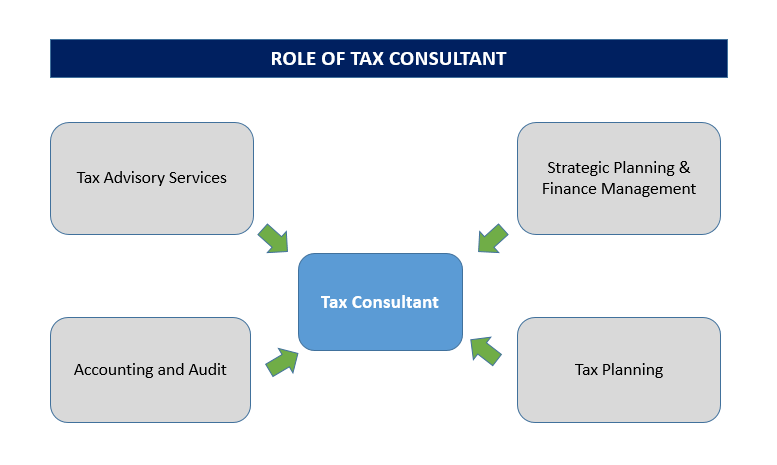

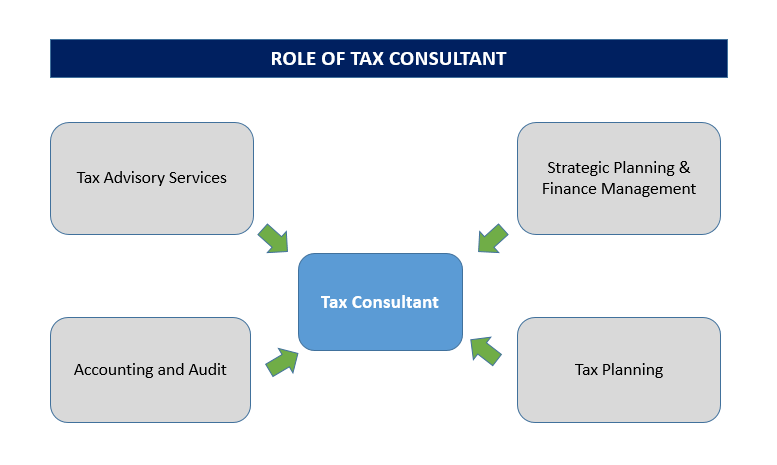

: Companies can entirely outsource all their accountancy as well as tax-related features making use of audit as well as tax solution carriers. A couple of suppliers offer a hybrid method where they provide accounting and tax obligation tools in addition to support and know-how, supporting services and also individuals that intend to undertake their very own bookkeeping as well as tax-related work in-house.

Late Or Unfiled Irs Tax Returns

Late Or Unfiled Irs Tax ReturnsBank Accounts (International and Domestic) USF divisions might not open any financial institution account (residential or international) without authorization from the College Controller's Workplace and Finance/Budget Management Council. There are tax considerations connected to all checking account. USF Excluded Standing and Residency Qualification USF may be called for to offer documentation of USF's excluded condition for grant application or other objectives.

The tax is comprised of a state and also local portion as well as each regional challenging territory has a specific rate (

page).

The 4-Minute Rule for Protecting Assets After Assessment

Tax Planning Services in Minneapolis We work relentlessly to assist you pay much less in taxes as the thorough local business tax preparation solutions citizens and local business owner can depend on. Our experience has actually assisted us to come to be one of the very best firms for local business tax obligation accountant services that Minneapolis has to offer. Company Formation Assistance.

We will generate a customized tax obligation cost savings prepare that permits you to purposefully reach your goals, and develop a framework that will certainly benefit both your expert and also individual requirements in order to maximize your interests. Discover exactly how we can help with your tax obligation requirements by booking a complimentary assessment with among our small business tax obligation preparation solution specialists.

View every one of your monetary declarations, tax obligation returns, and a lot more in a solitary area while you deal with Corneliuson.

Every CPA has an 18-month duration to pass AICPA's four-part test, which covers auditing as well as attestation, business ideas, bookkeeping as well as reporting and also regulations. When the exam is passed,

try these out the accounting professional puts on their specific state for licensure. Corporate Restructuring. Certified public accountants are also usually required to finish 40 hrs of continued education and learning every year.

Report this wiki page

Late Or Unfiled Irs Tax Returns

Late Or Unfiled Irs Tax Returns